Get free review of your pitch deck by Kapso

9 chapters, 7 steps

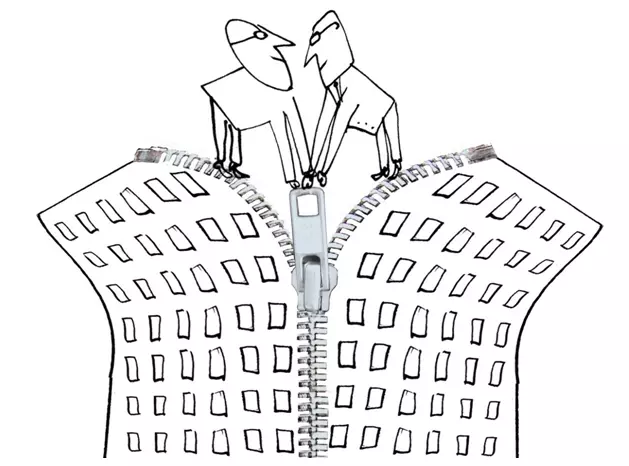

The merger and acquisition process can be either lengthy or short. Sometimes, the deal involving two large companies with global presence take years to reach a closure.

Generally, the merger and acquisition process can be either lengthy or short. Sometimes, the deal involving two large companies with global presence take years to reach a closure. Other times, both multi-billion dollar and small-medium market deals will take only a few months from initial talk to transaction announcement.

Closing an M&A deal is no easy process and there are several steps involved that makes sure that the deal goes through successfully. While it’s not mandatory that all deals follow these exact steps, this will give an overview of what happens in the background.

The first step, In any M&A process is to develop a strategy showing why the business should opt for a merger or acquisition and what the desired outcomes will be. Once the strategy is set, we start the evaluation process by identifying the growth opportunities in business, markets served, or any resulting combination. For find out the growth markets, businesses should collect and analyze data including details about clients, employers, competitors, demographics of consumers and their preferences/opinions.

While choosing suitable candidates for the M&A, businesses should keep in mind certain criteria such as company value, industry where the company is operating, their revenue and margins, current growth and future projections. Using these as primary criteria, the businesses can now look for candidates who are either in the same industry as them or in a completely different sector. The candidates are further assessed using management experience and consultants.

The businesses need to assess what could possibly be the benefits of a deal with the particular merger/acquisition target and what are the risks associated with the particular target. If there are more than one target company, then the business need to assess how one target compares to other targeted opportunities. Also, a comprehensive analysis of the financial as well as credit position of the target has to be carried out by means of financial forecasts. The financial assessment mainly focuses on revenue, cost and balance sheet of the target.

After considering all aspects, the management must determine all the likely benefits and drawbacks of the proposed merger or acquisition and arrive at a decision, whether to proceed with the deal or not. During this decision making process, leaders try to identify whether the strategic value added by the merged/acquired business is compelling enough to proceed or not.

One of the most important steps in any Merger and Acquisition deal is conducting the valuation of the target business. This process involves assessing the value of the target, identifying the alternatives for structuring the deal, selecting the structure that would be best suitable for the company to achieve its objectives and finally developing an offer. The accountants, financial and business analysts focus on the financial analysis and valuation of the business as well as checking the accuracy of the financial statements of the target company. There are mainly four key methods to conduct valuation of a business: Asset Based Valuation, Earnings (or Dividend) Based Valuation, CAPM Based Valuation and Valuation based on Present Value of Free Cash Flow. There four methods are covered in detail in the subsequent chapters.

Business valuation is one of the important steps because it can ruin the M&A deal if done wrong.

Once an offer is accepted, it is the responsibility of the top management of the acquiring organization to ensure a complete and thorough due diligence review of the target company in order to fully understand the opportunities, issues and the risks associated with the deal. Due Diligence comprises of a review of the target company’s financial, legal and operational position to make sure that the information obtained during the earlier stages of the acquisition process is accurate and there is a full disclosure of all the information relevant to the deal. Once due diligence is done, the involved parties begin the negotiations. Any regulatory approvals necessary for carrying out the transaction are obtained and the deal is closed. During the execution of the transaction, the acquirer should monitor the merger or the acquisition to ensure that the deal continues to meet the goals and objectives established for the transaction.

Once the transaction is implemented, the acquirer should take steps to ensure that the management will make necessary operational changes, if required, to achieve the financial benefits. Also, care should be given while analyzing the HR implications caused by the transaction as well as the potential legal and regulatory challenges. A successful merger or acquisition involves combining of two organizations in a manner that maximizes the value of the company while minimizing the disruption to its existing operations. This includes having a ready mechanism to deal with any future problem in the implementation of the deal.

1. Irrespective of the size of the company, an M&A can either be a short or a lengthy process

2. Once the acquirer develops a strategy and identifies the potential candidates, the next important step is to analyze the strategic fit of the target.

3. Business Valuation is one of the most important steps in any M&A deal as, if this step goes wrong the entire deal goes wrong.

4. After the deal is finalized, it is the responsibility of the merged organization / acquirer to continuously monitor the organization and the environment to ensure that every thing works smoothly.

Kapso is an ISO-certified boutique M&A firm founded out of a passion to provide best-in-class services to our clients. We distinguish ourselves by the depth of our knowledge of India's SME landscape, and we specialize in assisting firms with the acquisition and fundraising process from the initial stages of collateral preparation through deal closure.

We aspire to become a long-term valued partner of businesses and entrepreneurs, assisting them in realizing their full potential by providing a unique viewpoint, blend of expertise, and perseverance to our clients' needs.

Pantomath, Nucleus House

Saki Vihar Rd, Raje Shivaji Nagar

Marol, Andheri East, Mumbai

Maharashtra 400072