Have you ever felt the need to understand the financial landscape of the business industry? Then, you are at the right place. In this blog, we will discuss the numerous aspects encircling the financial landscape of the business industry.

However, before we move forward with our discussion, let’s quickly take a look at the basics of the financial landscape.

Let us first get to know and understand the financial landscape, then move on to answer all your questions like- what is a financial landscape, why is it so important to understand the financial landscape in the business industry, how is it going to prove beneficial for you, etc.

Wondering what is a financial landscape? Here’s a simple answer to your question.

The financial landscape of any business is the system that records all the financial transactions between the participants such as the exchange of money between investors, borrowers, or lenders.

If you are also wondering what is the aim of knowing the financial landscape, then let me tell you that it primarily focuses on driving economic growth by facilitating the flow of funds.

So, all in all, we can say that the financial landscape is the record of all the money that comes in and goes out. You can think of it as the way your mother keeps a record of all the expenses, savings, and extra expenditures at home.

Cool, isn’t it to know about the financial landscape of the business industry and pull your socks and get ready to tackle any financial problem or any issues related to the financial participants by monitoring, and regulating them?

Read more and learn about B2B marketing strategies.

Key Components of the Financial Landscape

Now that you are acquainted with the basics of a financial landscape. Let us dive into the key components of the financial landscape. The following are the key components of the financial landscape that are essential parts of the system. You need to know about these before we move forward and understand the structure financial market.

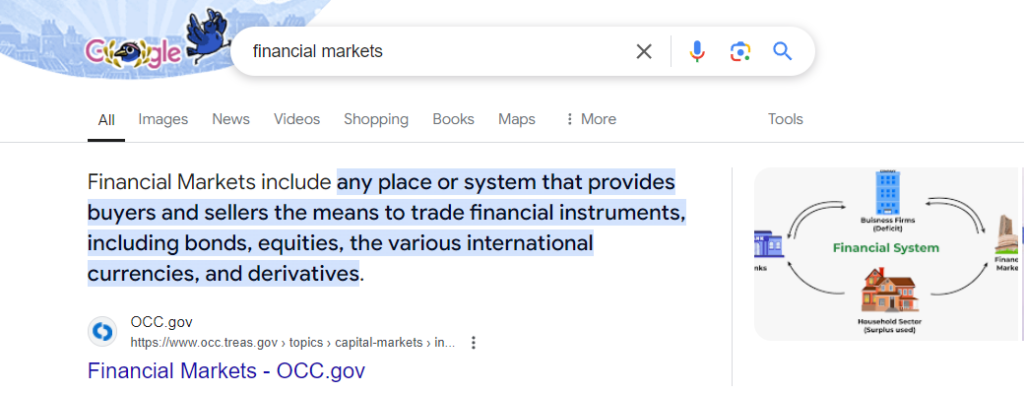

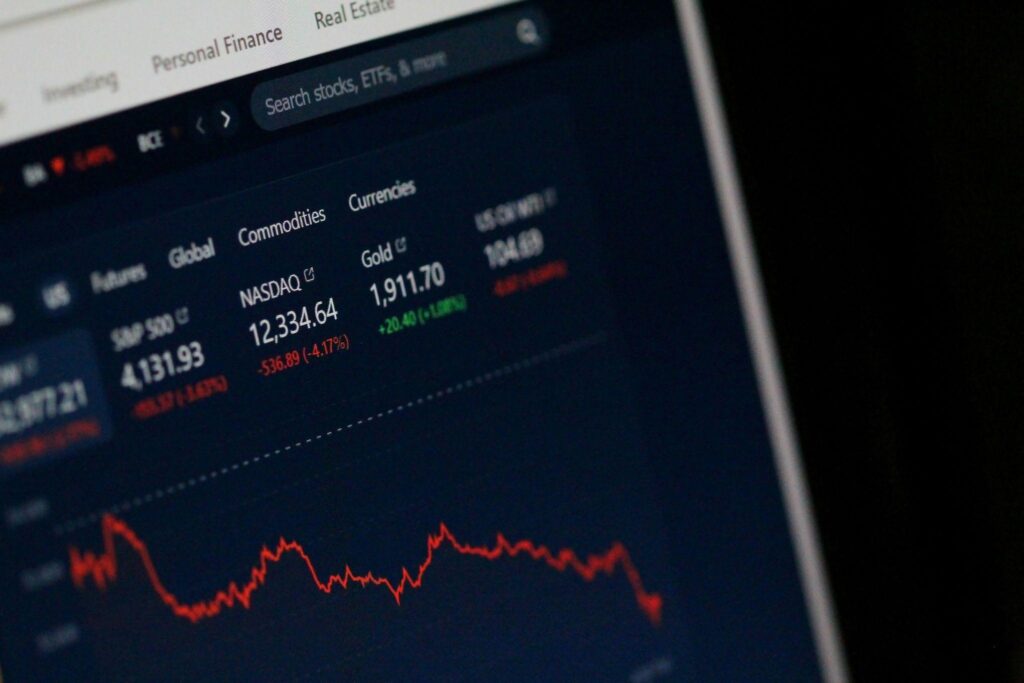

- Financial Markets– so, first things first, let us understand what is a financial market. A financial market is a marketplace where securities can be traded. This may include stock markets, bond markets, etc. These financial markets hold a crucial place in capitalist economies.

- Financial Institutions– so, next up we have financial institutions. In simple words, financial institutions are institutions or organizations that deal with all kinds of financial transactions such as loans, or even investments for that matter. Now, the question arises, what are the different kinds of financial institutions? For that let me tell you that there are different types of financial institutions working towards different goals. Such as an Insurance company is also a financial institution, however, it works to eradicate the risk of loss rather than giving out loans. Hence, it can be said that all financial institutions have a role to fulfill. Some examples of financial institutions are lenders, banks, stock brokers, etc.

- Financial Instruments– A financial instrument is any instrument that holds value. As for the value that we see here, it can be in terms of monetary value or for investment purposes. These financial instruments include assets such as cheques, bonds, and securities that can later be used for trading or for making some kind of investment. If you are pondering upon the importance of these financial instruments then listen up, these financial instruments can benefit businesses or individuals who have no access to credit or savings. A proper management of financial instruments may help individuals and businesses to reduce material costs and increase sales and hence, will in turn increase your profits. Some examples of financial instruments are derivatives, securities, bonds, foreign exchange, mutual funds, shares, etc.

- Financial Regulations– if you have ever heard of scams and other financial crimes, then you should be aware of the fact that there is also something known as financial regulations. Financial regulation basically means the laws, rules, and regulations that govern the financial landscape or more specifically the financial institutions. To give you an example to elucidate my point, I would say that these financial regulations is the same as we have laws and rules in our countries, and it is our duty to abide by these laws, similarly, it is crucial for financial institutions to follow the rules and laws placed down. The financial regulations primarily direct their focus on providing financial safety, consumer protection, eradication of financial crimes, and free and fair competition.

Financial Market Structure

In the points mentioned above, we have seen some of the very important key components with regard to the financial landscape of the business industry. And I hope that now you have a clear idea of where this blog is taking you.

Let us now move on to the next crucial aspect of the financial landscape which is the financial market structure.

So, clearing the basics first, what is a financial market? A financial market is any marketplace that provides both, the buyers, and the sellers with a platform to trade their financial instruments. Financial instruments are instruments such as bonds, shares, equities, etc. as already discussed above, right?

Now, the next question that arises is, what is a market structure, and why is it important to have knowledge about the market structure?

So, let us jump right into it, and discuss the answers to all your questions, and solve all your questions and queries.

There are different types of financial markets, such as the primary market, secondary market, the over-the-counter markets. Let’s discuss these types of markets in detail.

- Primary markets– So, to start with the primary markets. What is primary? Primary is something that is new and unique. Therefore, it can be said that primary markets are the markets in which companies offer new securities that have not been traded previously. In primary markets, companies offer securities to people or individuals, so to speak, and their aim is to raise funds that could help in financing their long-term goals.

- Secondary markets– unlike primary markets, secondary markets are marketplaces, where the trading of shares, securities, and other financial instruments takes place between the investors without the interference of the issuing companies. The secondary markets primarily focus on providing liquidity to the traders, which in turn facilitates maximum capital allocation, and can be beneficial for price determination.

- Over-the-counter markets– now, that you have a clear understanding of primary and secondary markets, let us move forward to OTC markets. So, OTC is an abbreviation used for Over-the-counter markets. Now, the question arises, what does it mean? These over-the-counter markets are places where financial instruments like bonds, shares, and derivatives are traded directly between counterparts. In such cases, there is most of the time absence of any trade regulator. In such a marketplace as OTC the stocks that are traded are mostly the ones that are unlisted and may or may not be available in the mainstream stock markets.

Financial Instruments and Products

Financial instruments as discussed before are the tools that can be traded, purchased, created, modified, and settled, for monetary exchanges. These items include stocks, derivatives, bonds, shares, debentures, cash deposits, etc.

Moving on to the next part on the same lines is financial products. Let’s see what are financial products.

Now, the financial product is somewhat like a financial instrument, but not the same though. So, to simply state and answer your answer, it can be said that a financial product is something that helps one to make financial investments as well as to make non-cash payments when acquired.

Some examples of financial products include shares, bonds, loans, credits, etc.

Conclusion

This was all about understanding the financial landscape of the business industry. I hope that this blog has shed some light over your queries and concerns regarding the terms and terminologies of finance and financial landscapes. For a quick recap of all the points discussed above, please keep reading further.

The financial landscape of the business industry is a system that records all financial transactions between participants, such as the exchange of money between investors, borrowers, or lenders. It primarily focuses on driving economic growth by facilitating the flow of funds. This is similar to how your mother keeps a record of all expenses, savings, and extra expenditures at home.

To understand the financial landscape of the business industry, it is essential to know the key components: financial markets, financial institutions, financial instruments, and financial regulations. Financial markets are marketplaces where securities can be traded, such as stock markets and bond markets, which hold a crucial place in capitalist economies. Financial institutions deal with various types of financial transactions, such as loans and investments. Examples of financial institutions include lenders, banks, and stock brokers.

Financial instruments are any instrument that holds value, either in terms of monetary value or for investment purposes. Examples of financial instruments include derivatives, securities, bonds, foreign exchange, mutual funds, and shares. Proper management of these financial instruments can help individuals and businesses reduce material costs, increase sales, and ultimately increase profits

Financial regulations are laws, rules, and regulations that govern the financial landscape or more specifically the financial institutions. They primarily focus on providing financial safety, consumer protection, eradication of financial crimes, and free and fair competition.

The financial market structure is another crucial aspect of the financial landscape. There are different types of financial markets, such as primary markets, secondary markets, and over-the-counter markets. Primary markets are new and unique markets where companies offer new securities that have not been traded previously. Secondary markets are marketplaces where trading of shares, securities, and other financial instruments takes place between investors without the interference of the issuing companies. They primarily focus on providing liquidity to traders, which facilitates maximum capital allocation and can be beneficial for price determination.

Over-the-counter markets (OTC) are places where financial instruments like bonds, shares, and derivatives are traded directly between counterparts, often without the presence of any trade regulator. In OTC markets, the stocks that are traded are mostly unlisted and may or may not be available in mainstream stock markets.

Financial instruments are tools that can be traded, purchased, created, modified, and settled for monetary exchanges, such as stocks, derivatives, bonds, shares, debentures, and cash deposits. Financial products, on the other hand, are tools that help individuals make financial investments and non-cash payments when acquired. Examples of financial products include shares, bonds, loans, and credits. Both financial instruments and products play a crucial role in facilitating transactions and ensuring financial stability.

In summary, understanding the financial landscape of the business industry is crucial for businesses to effectively manage their finances and address financial issues. By understanding the key components of the financial landscape, including financial markets, institutions, and financial regulations, businesses can better navigate the complex and dynamic world of the business industry.