Do you want to know your company’s fair market value?

Well, for this you need to prepare a business valuation. It is important to know your company’s true value for business valuation preparation – no matter whether you want to sell it, get an investment, or just plan for the future. Also, it would be wise to take the assistance of professional business valuation services. They can provide you with an accurate valuation of your business.

Below are some easy steps to prepare for business valuation:

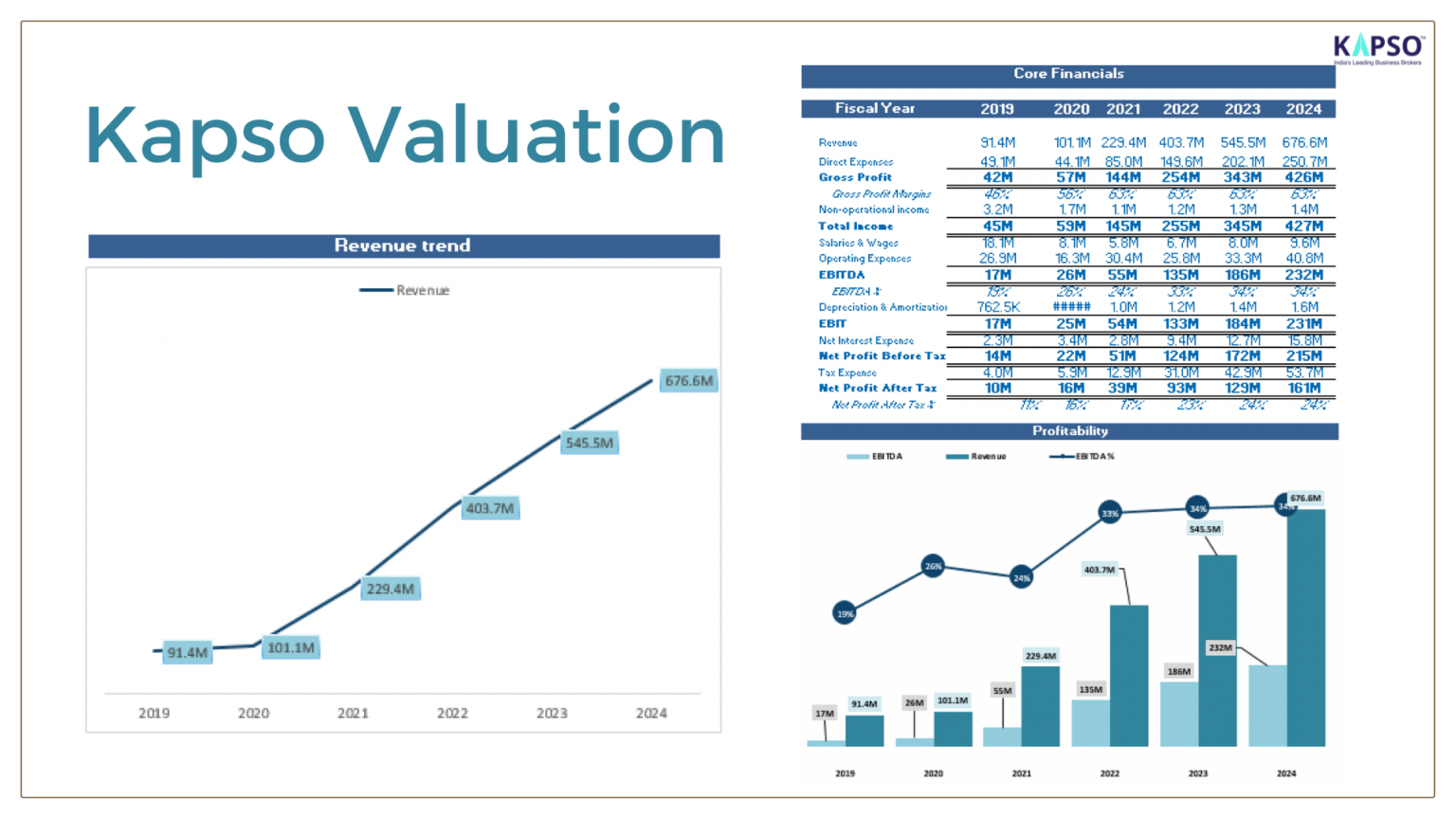

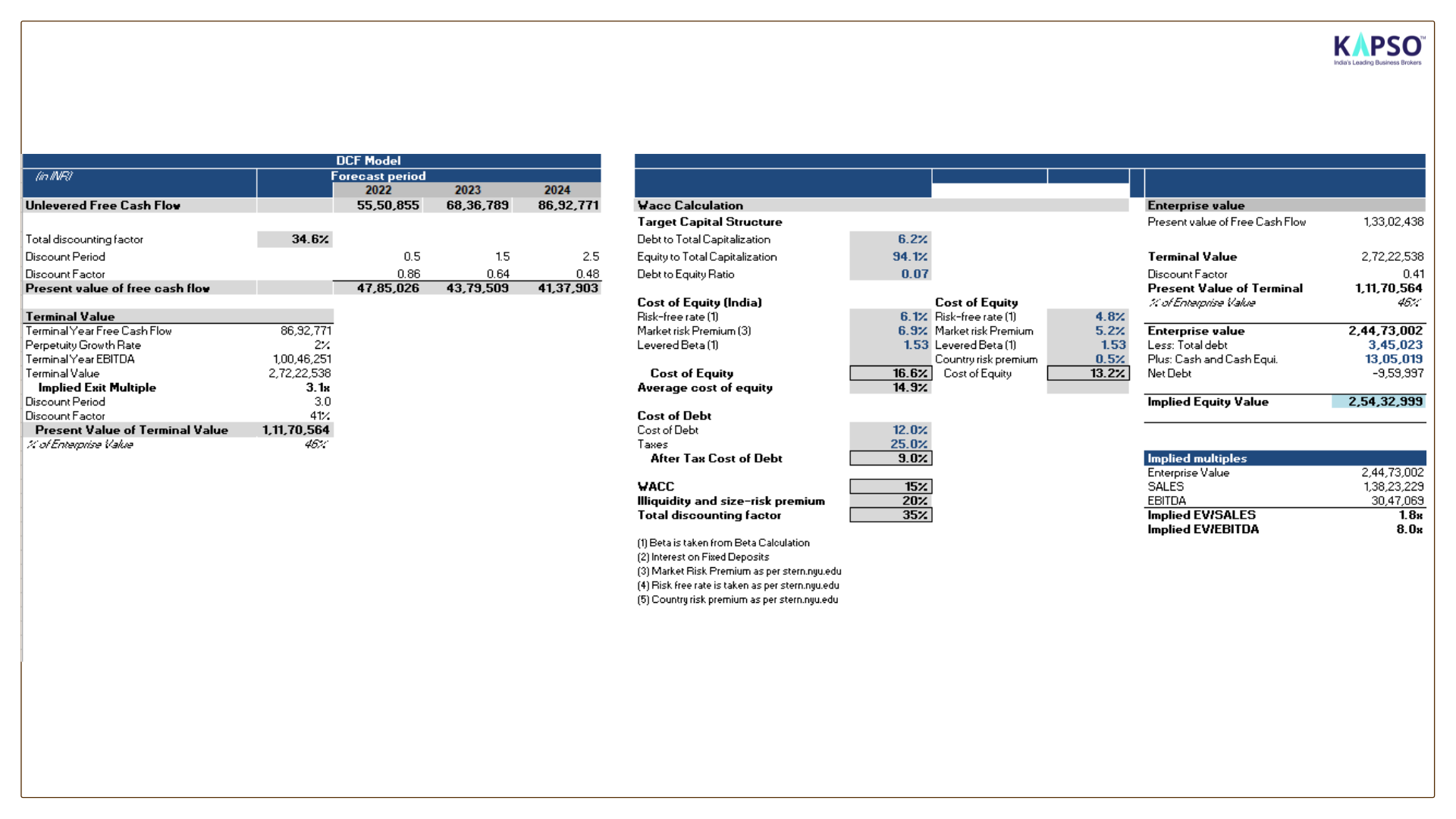

1. Choose the Right Method: The method for valuing a business depends on its purpose, industry, and stage. There are three major approaches – market, income, and asset approach, each with its pros and cons. The market approach uses similar businesses’ revenue or earnings multiples. The income approach calculates the current value of future cash earnings. The asset approach calculates net assets, adjusting for intangibles.

2. Organize Your Financial Records and Data: You need to collect financial records and data like statements, tax returns, contracts, customer lists, market research, etc.

Having these records and maintaining them provides the foundation for any valuation. Business valuation services rely heavily on these financial records to assess your business’s value.

3. Review Your Business Operations: Next, assess your processes, systems, and overall efficiency. A well-run business with clear processes is more likely to receive a higher valuation. Consider the following:

• Document procedures for all essential tasks.

• Define the roles and responsibilities of every employee clearly in your business.

• Having an efficient supply chain and inventory management can impact your valuation positively.

4. Assess Your Market Position: It is vital to understand your business’s position in the market to be prepared for a valuation. Know about your market shares. Also, identify what makes your business different from others.

5. Know Your Strengths and Weaknesses: For business valuation, show every aspect of your business including, what makes you unique & competitive, customer base, market value, revenue stream, innovation, and team. Also, be honest about and tell your weaknesses or any risks, vulnerabilities, legal challenges, etc.

6. Address Outstanding Issues: Before a professional valuation, it’s important to resolve any outstanding issues that could negatively impact your business’s value. If you are having some legal issues, it’s better to resolve them. Also, work on reducing or restructuring any outstanding debt. Your business should be fully compliant with all industry regulations.

7. Consult with a Professional: Valuation is a difficult process, which requires expertise. Therefore consider consulting with a professional before the valuation. Experienced business valuation services can offer valuable insights and help you prepare. These professionals can help choose you the right method, and collect relevant data, along with helping you avoid common mistakes. Also, professional advice can save you time and enhance your credibility.

Conclusion:

Preparing your business for a professional valuation requires careful planning and organization. By following the steps mentioned above, you can help ensure your business receives an accurate and favorable valuation. Whether you’re seeking to sell, attract investors, or simply understand your business’s worth, a well-prepared valuation can provide the insights you need.